The RSI indicator is powerful, but its performance depends heavily on the settings you choose. In this guide, we’ll explore the best RSI periods, levels, and how to adjust them for stocks, crypto, and forex markets.

What Are the Default RSI Settings?

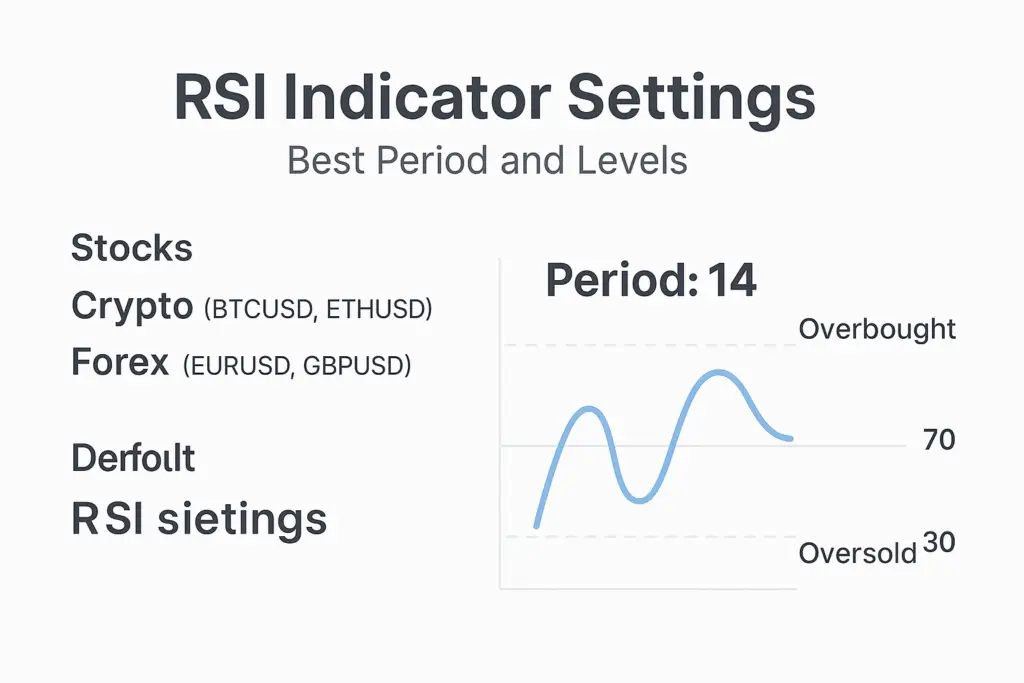

The standard RSI setting is:

- Period: 14

- Overbought level: 70

- Oversold level: 30

This means RSI calculates based on the last 14 candles and flags values above 70 as overbought, and below 30 as oversold.

Best RSI Settings for Stocks

- Period: 14 (default)

- Why: Offers a balanced signal for swing and positional trading

- Intraday Tip: You can use a shorter RSI (like 7 or 9) for faster signals

Best RSI Settings for Crypto

- Period: 14 or 9

- Why: Crypto is more volatile, so shorter periods can respond quicker

- Suggested levels: 80 (overbought), 20 (oversold) to reduce false signals

Best RSI Settings for Forex

- Period: 14

- Why: Forex traders often follow the default for consistent performance

- Timeframes: RSI on 15min, 1H, and 4H works well for day and swing trading

RSI Levels – When to Change Them

You can tweak the default 70/30 levels depending on market conditions:

- Trending Market: Use 80/20 to avoid early reversals

- Range-Bound Market: Stick to 70/30 for clear reversal signals

- Fast Scalping: Use 60/40 or 65/35 for quicker setups

Always backtest before relying on non-standard settings.

Example Comparison

| Market | Period | Overbought | Oversold |

|---|---|---|---|

| Stocks | 14 | 70 | 30 |

| Crypto | 9 | 80 | 20 |

| Forex | 14 | 70 | 30 |

Conclusion

There is no one-size-fits-all RSI setting. The best approach is to test settings based on your market and trading style. Start with 14-period RSI, then adjust based on speed, risk, and accuracy.

FAQs

What RSI setting is best for day trading?

Try RSI 7 or 9 for quicker signals. Stick with 14 if you prefer more stability.

Should RSI levels be changed for crypto?

Yes. Crypto volatility makes 80/20 more reliable than 70/30.

Can I use RSI 5 or 6?

Yes, but they can produce more false signals. Use with caution and confirmation.