RSI Indicator Formula Explained – Simple Breakdown for Beginners

The RSI (Relative Strength Index) is one of the most beginner-friendly trading indicators. But do you know how it’s calculated?

In this post, we’ll explain the RSI formula, how it works, and why it matters — in plain language anyone can understand.

What is the RSI Formula?

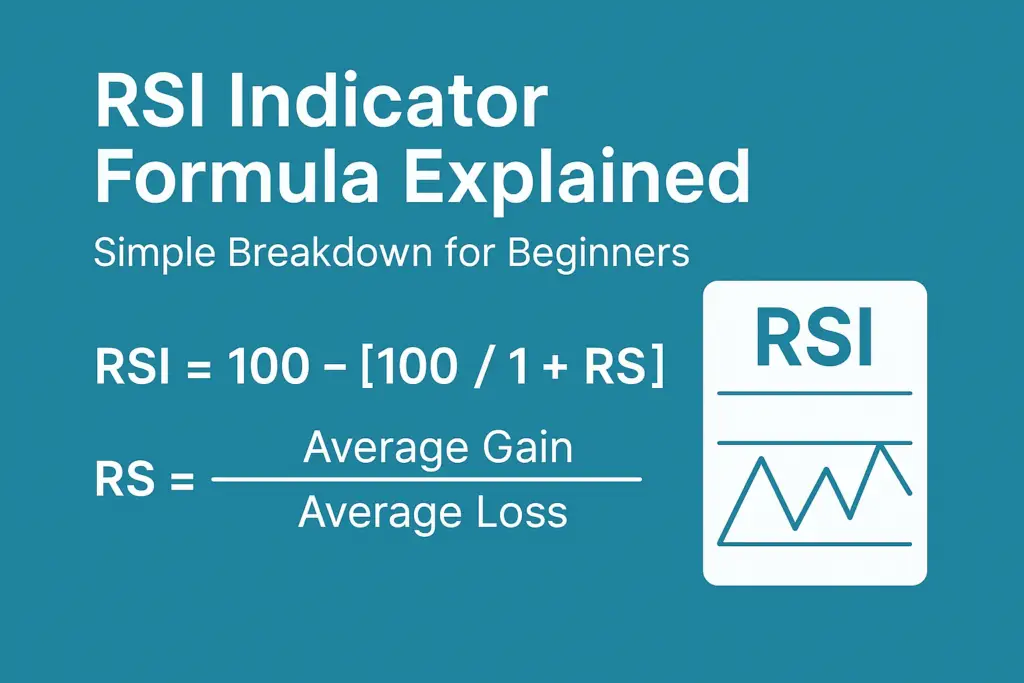

The standard RSI formula is:

RSI = 100 – [100 / (1 + RS)]

Where:

RS = Average Gain over X periods / Average Loss over X periods

Most traders use a 14-period setting, which means the formula looks at the last 14 candles on the chart.

Step-by-Step RSI Formula Breakdown

Let’s break it down into simple steps:

- Calculate average gain over the last 14 periods

- Calculate average loss over the last 14 periods

- Divide gain by loss to get RS (Relative Strength)

- Plug RS into the main RSI formula

- Get the final value (between 0 and 100)

RSI Example (Simple Numbers)

Let’s say:

- Average gain over 14 periods = 1.2

- Average loss over 14 periods = 0.8

Then:

- RS = 1.2 / 0.8 = 1.5

- RSI = 100 – [100 / (1 + 1.5)]

- RSI = 100 – [100 / 2.5] = 100 – 40 = 60

So, the RSI value would be 60.

Why the RSI Formula Matters

Understanding the formula helps you:

- Trust the indicator more

- Avoid relying blindly on buy/sell signals

- Adjust RSI periods for better accuracy

- Use RSI with more confidence in different markets

Should You Manually Calculate RSI?

No — trading platforms like TradingView, MetaTrader, and most apps calculate RSI instantly. But knowing the logic behind the number gives you a trader’s edge.

Conclusion

The RSI formula might look complex, but it’s just math behind a powerful tool. Once you know how it’s calculated, you’ll start using RSI more wisely in your trading.

🔍 FAQs

What is the full formula of RSI?

RSI = 100 – [100 / (1 + RS)], where RS is average gain divided by average loss.

Why is RSI calculated using 14 periods?

14 is a standard setting recommended by the creator, J. Welles Wilder, for a good balance between sensitivity and stability.

Can I use a different period like RSI 9 or RSI 21?

Yes. Shorter periods = more sensitive. Longer periods = smoother signals.

Does the formula change for crypto, stocks, or forex?

No — the formula is the same across all asset classes.